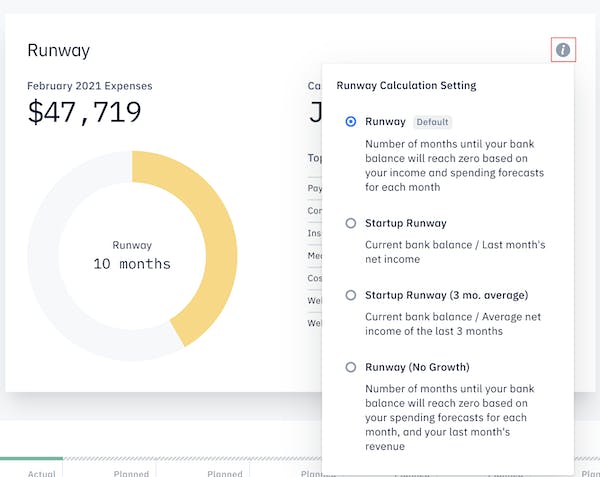

Runway Chart Settings

On Pry we have multiple ways of calculating your Runway to suit your preference. We will go over each method and list out the pros and cons to each method. To change the runway calculation method, simply click on the ℹ️ icon next to the runway chart and select the method you want to use.

Runway (Default)

The default runway chart takes your most recent bank balance and calculate the number of months until your bank balance will reach zero based on your forecasted income and spending for each month.

Pros

- Takes into account future income and expense growth, both positive and negative.

- Can give you the most accurate runway of all the methods.

- The most realistic one if the financial plan is managed very closely.

Cons

- Relies heavily on user to be accurate on projected expenses.

- Will not provide useful data without setting up your financial plan on Pry.

- May display a more optimistic scenario if you are aggressive on your revenue forecast.

Startup Runway

The startup runway takes your bank balance and divide it by your last month's net income. This is the more traditional way of calculating runway and when mentioned in conversations amongst peers, this is usually the method they are referencing to. It is a simple and quick calculation which tells you how many months of burn you have left based on your last month's activity.

Pros

- Easy to calculate.

- You can know your runway right away after connecting your financial accounts to Pry.

- You do not need a financial plan set up.

Cons

- Your last month's performance may not reflect your future burn.

- Heavily impacted by one time outlier expenses.

- You cannot see how future expenses affect your runway. This includes future headcount or fixed expenses.

- Relies on your books to be up to date.

Startup Runway (3mo. average)

The startup runway 3mo average is an adjusted version of the startup runway. As the name suggests, it takes your bank balance and divide it by the average net income of the last 3 months. This version is a variation of the Startup Runway where it flattens out any outlier expenses, while sharing the Pros of the Startup Runway method.

Pros

- Easy to calculate.

- You can know your runway right away after connecting your financial accounts to Pry.

- You do not need a financial plan set up.

Cons

- Your last 3 month's performance may not reflect your future burn.

- You cannot see how future expenses affect your runway. This includes future headcount or fixed expenses.

- Relies on your books to be up to date.

Runway (No Growth)

The Runway (No Growth) method calculates the number of months until your bank balance will reach zero based on your forecasted spending, while using your last month's revenue. The name no growth comes from keeping your revenue stagnant (0% growth rate). This gives you a more conservative calculation of your runway.

Pros

- Takes into account future expense growth, both positive and negative.

- Gives you the most conservative method out of all the calculations.

- Is not impacted by revenue forecasts & goals.

Cons

- Will not provide useful data without setting up your forecasts and hiring costs on Pry.

- Relies on accuracy of projected expenses.

- Relies on your books to be up to date.