CAPEX Planning for Startups

One-Time CapEx

You do not spend tens of hours researching the best spreadsheet setup for your capital expenditure (CAPEX for short) plan. Pry has the most uncomplicated and straightforward modeling tool that allows you to set up CAPEX quickly and flow it through all of your financial statements in a few clicks.

In this tutorial, we will be booking the CAPEX for an equipment purchase at a fictional company.

A long-term asset such as equipment has a useful life, usually counted in months or years. Therefore, the asset's value on book will keep decreasing throughout its useful life until it reaches zero, gets sold off, or is written off. This process is known as depreciation. An asset is considered fully depreciated when its value on book reaches zero. The easiest way to account for depreciation is using the straight-line depreciation method: Where the decrease in the asset's value is the same every month during the asset's useful line (assuming the asset will be fully depreciated).

To simplify things, we will assume the equipment will be fully depreciated using straight-line depreciation, thrown away at the end of its useful life, and the following:

- The CapEx equipment costs a total of $120,000 and will be purchased on Jan 2023

- The CapEx equipment will have a useful life of 2 years (or 24 months)

When it comes to planning for these CapEx expenses, there are essentially only 3 steps you will need to do on Pry:

- Create a forecast for the purchase

- Create the forecasts for the depreciation of the asset

- Book the depreciation forecasts against your Accumulated Depreciation account

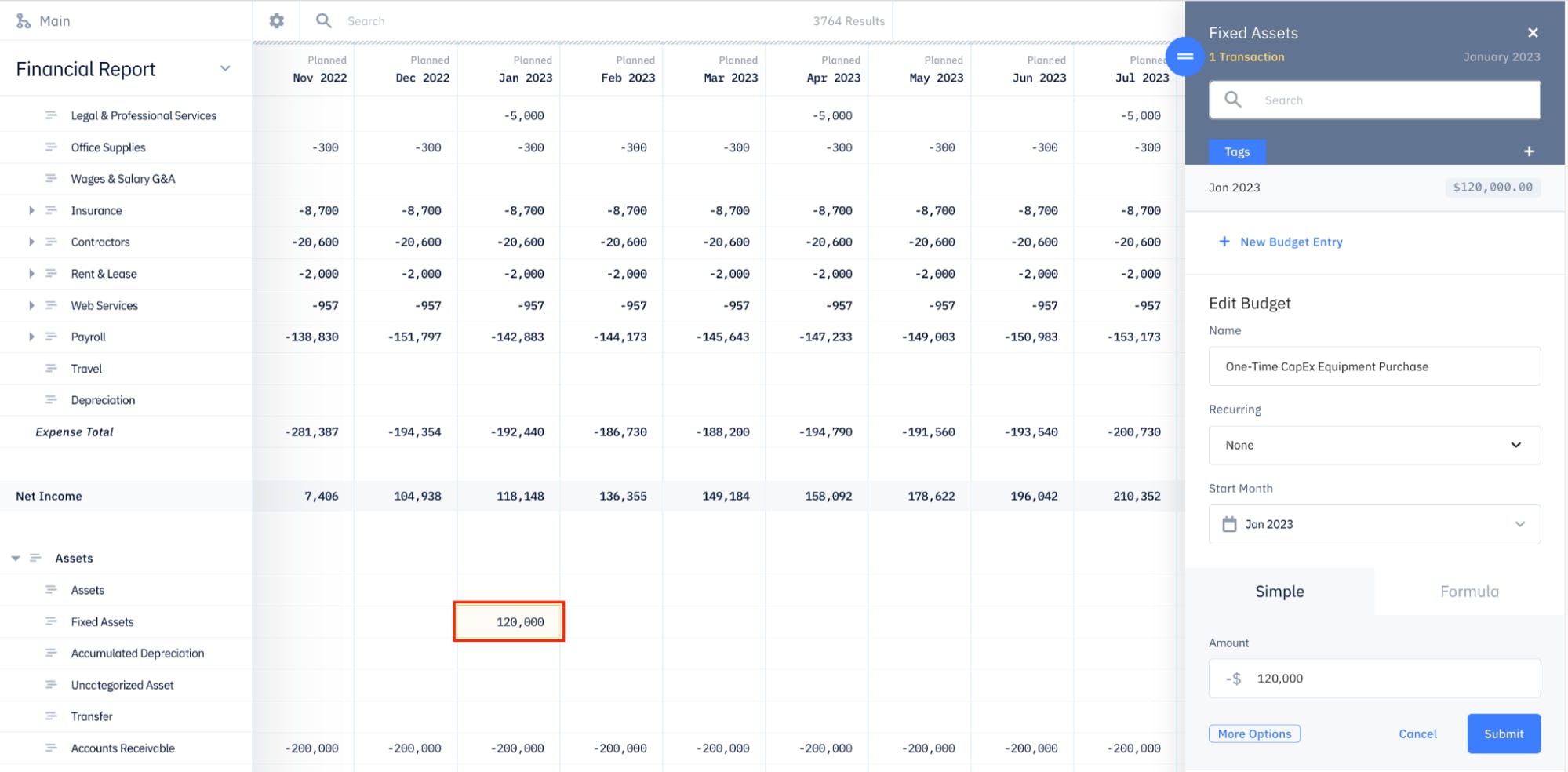

Planning for the one-time CapEx purchase

Since this will be a one-time purchase, we don’t need a formula and can just use the simple forecast feature. We can create this forecast of $120,000 on Jan 2023 in our Fixed Assets account directly on the Financial Report:

By creating this forecast, we have just increased our Fixed Assets account by $120,000 and decreased our total cash balance by $120,000 in Jan 2023.

Planning for the depreciation

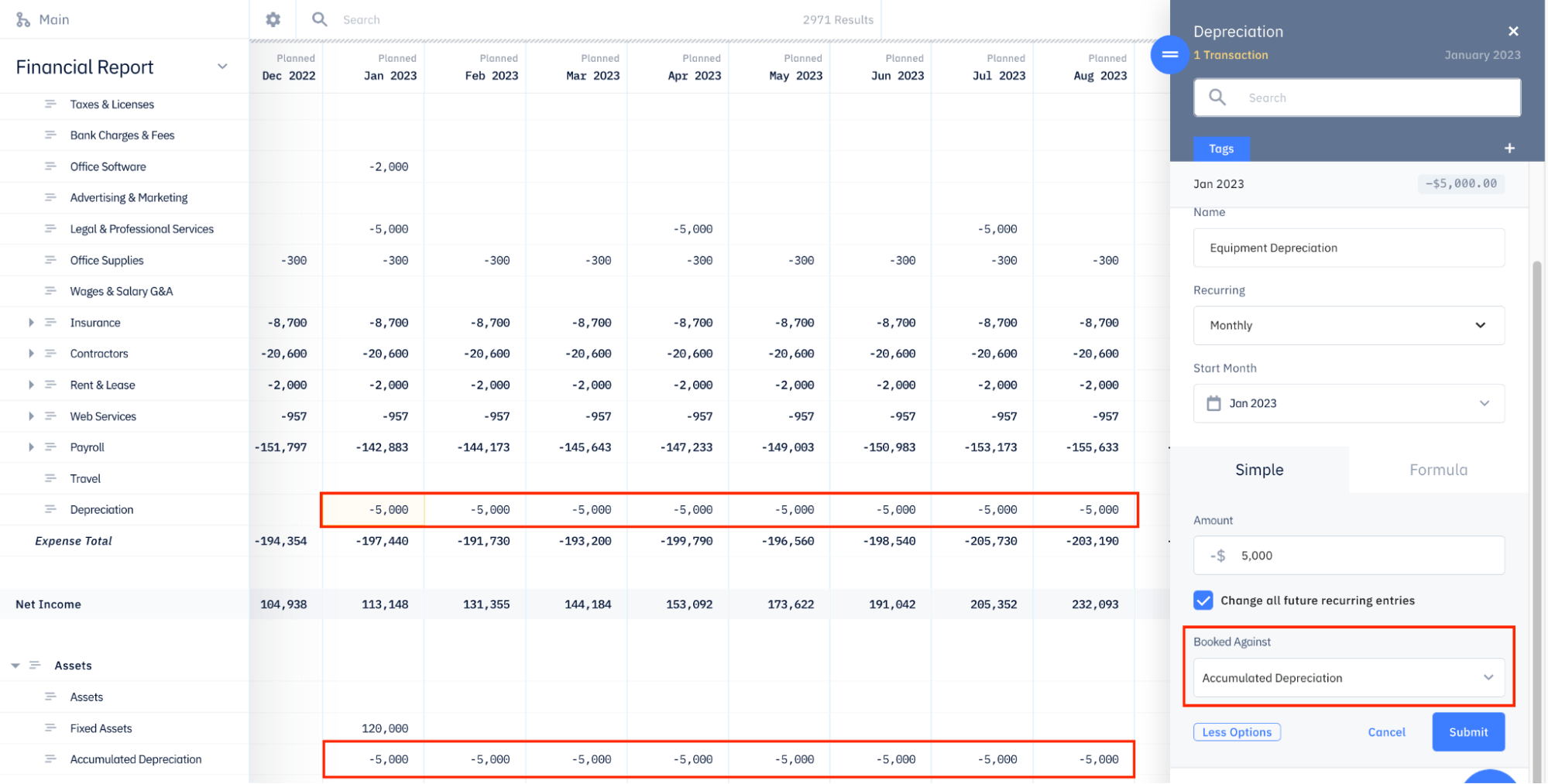

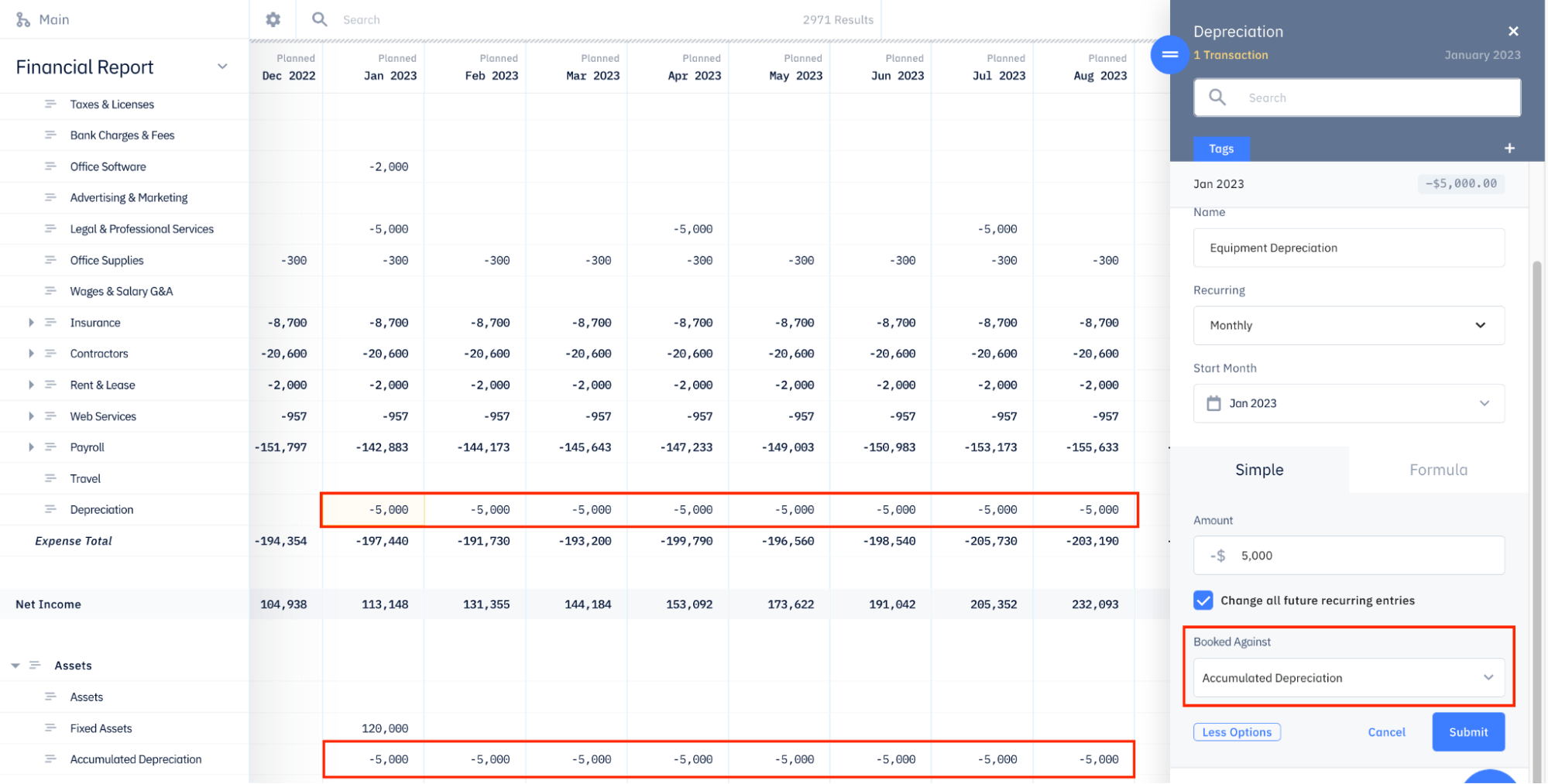

Since we’re using the straight-line depreciation method and assuming that the one-time equipment will have a useful life of 24 months, that means the equipment will depreciate at a constant rate of $5,000 per month between Jan 2023 and Dec 2025, inclusive. In addition, similar to the purchase of the equipment, we can use the simple forecast feature for the depreciation of the equipment.

For this $5,000 recurring monthly forecast, we will need to create it in our Depreciation Expense account starting on the month we’ve purchased the equipment (Jan 2023):

However, after creating this forecast, you should notice that the $5,000 is recurring for every month indefinitely. Therefore, in order for this forecast to only last for 24 months, we can stop this forecast from recurring every month after Dec 2025 by deleting all future entries of this forecast starting in Jan 2026.

Booking Against Accumulated Depreciation

Now for the final step of this tutorial, we need to use the booked against feature so that the depreciation forecast we’ve just created doesn’t affect our cash balance (since it is a non-cash expense) and decreases our total Assets.

To do this, we can edit the depreciation forecast in Jan 2023 and click “More Options” at the bottom of the tab. You will then be able to change the “Booked Against” field from “Banks” to “Accumulated Depreciation”.

Once you finish this last step, you will see that the $5,000 monthly recurring depreciation forecast will no longer be affecting your cash balance and is decreasing your total Assets by $5,000 every month for 24 months.

Recurring CapEx

In the tutorial above, we went over how to plan for a one-time CapEx purchase. However, companies typically also have recurring CapEx purchases as well. Therefore, for this tutorial, we’ll walk you through how you can plan for these expenses.

Similar to the One-Time CapEx tutorial, we will simplify things by assuming the equipment will be fully depreciated with the straight-line depreciation method, thrown away after its useful life, and the following:

- The equipment will be purchased for every new employee

- The equipment will cost $2,000

- The equipment will have a useful life of 24 months

Instead of using the simple forecast feature, we are going to need to use the Models feature for this tutorial, however, the logic is still the same:

- Plan for the purchases

- Plan for the depreciation

- Book the depreciation forecasts against your Accumulated Depreciation account

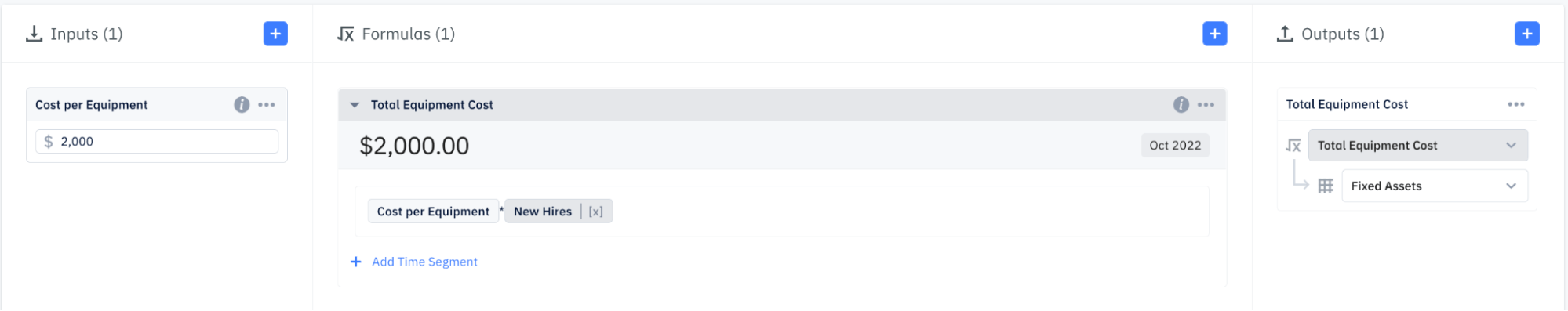

Planning for the purchase

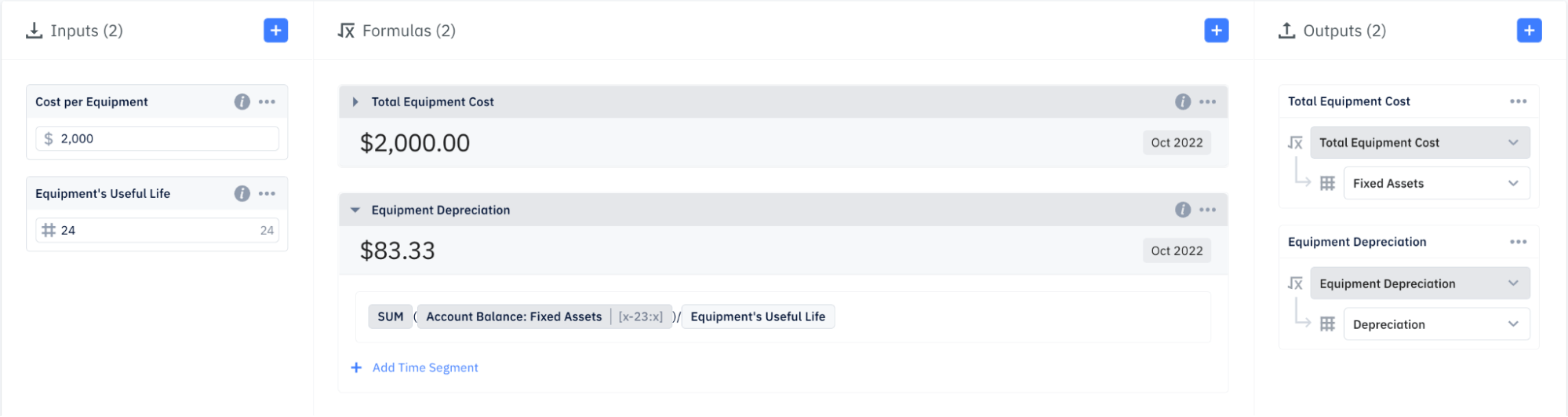

To begin the forecasts for purchasing this equipment, let’s create a currency input of $2,000 for the cost of the equipment. After creating the input, we can then start creating a formula to calculate the total cost of the equipment per month based on the number of new employees we hire.

The formula for this is actually quite simple: multiply the currency input we’ve just created by the pre-built New Hires function:

You can then output this formula to your Fixed Assets account on the Financial Report so that your total assets increase based on the number of new employees you have per month and your total cash balance decreases by the same amount.

Planning for the depreciation

Now, for the depreciation, we will need to create a new number input of 24 months (to represent the equipment’s useful life) and a new formula for the depreciation of the equipment. Since this new formula will essentially be a cumulative sum of all your historical purchases of the equipment for the past 24 months, we can use the following equation:

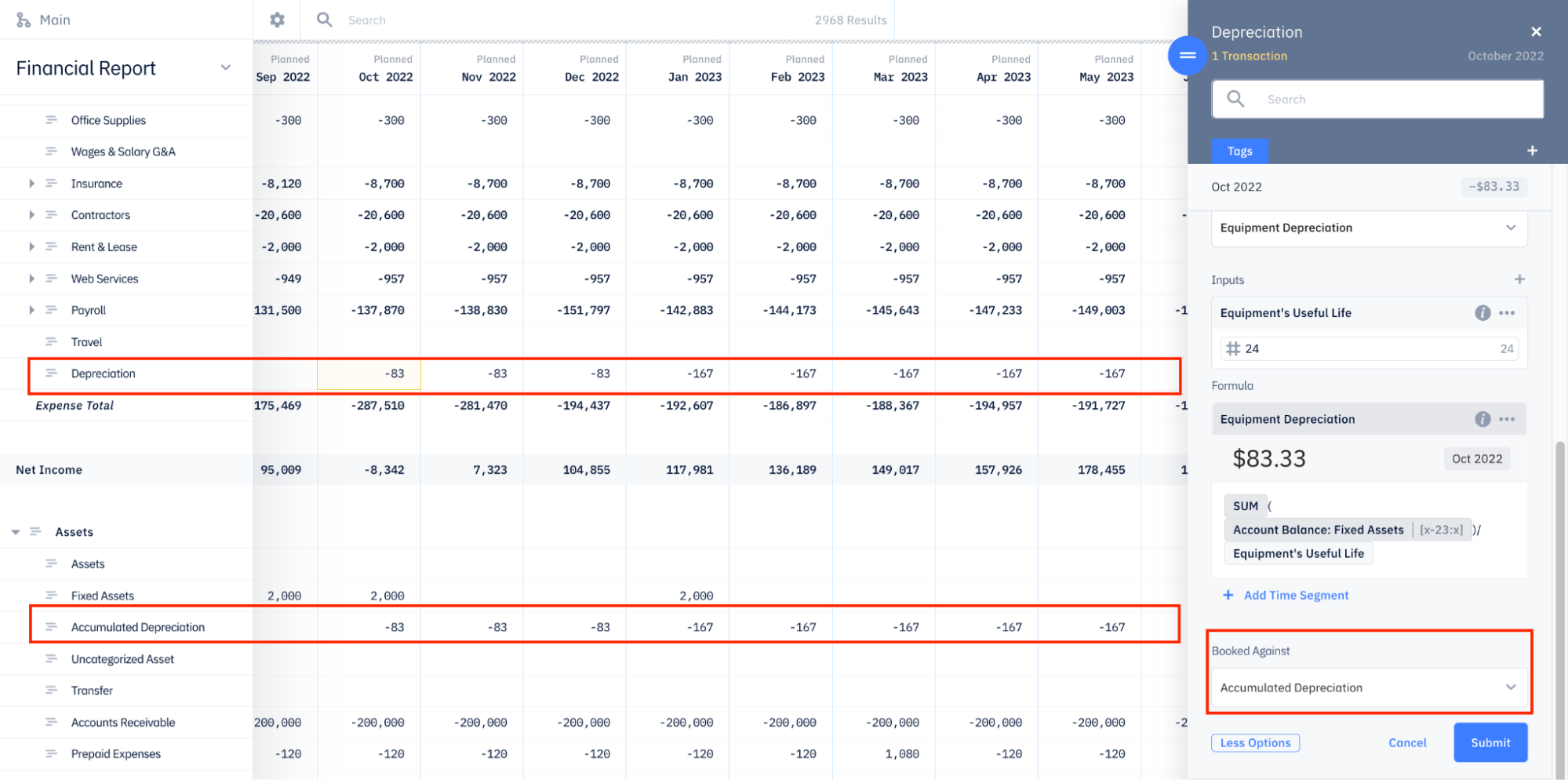

After creating the formula above, we need to map it to our Depreciation Expense account so that it affects our Financial Report.

Booking Against Accumulated Depreciation

By creating the output for the depreciation formula, it is now showing up on our Financial Report. However, we have to remember that since this is a non-cash expense, we also need to book it against our Accumulated Depreciation Asset account.

Once this is all done, both of these formulas will automatically update based on the new hires you enter in your Hiring Plan.