Using Financial Ratios to Measure Startup Performance

As a startup founder, it's essential to keep a close eye on your business's financial performance. One of the best ways to do this is by using financial ratios. Financial ratios are a set of metrics that help you understand how your business is performing, identify areas for improvement, and make data-driven decisions. In this guide, we'll explore some of the most important financial ratios for startups and how to use them to measure your business's performance.

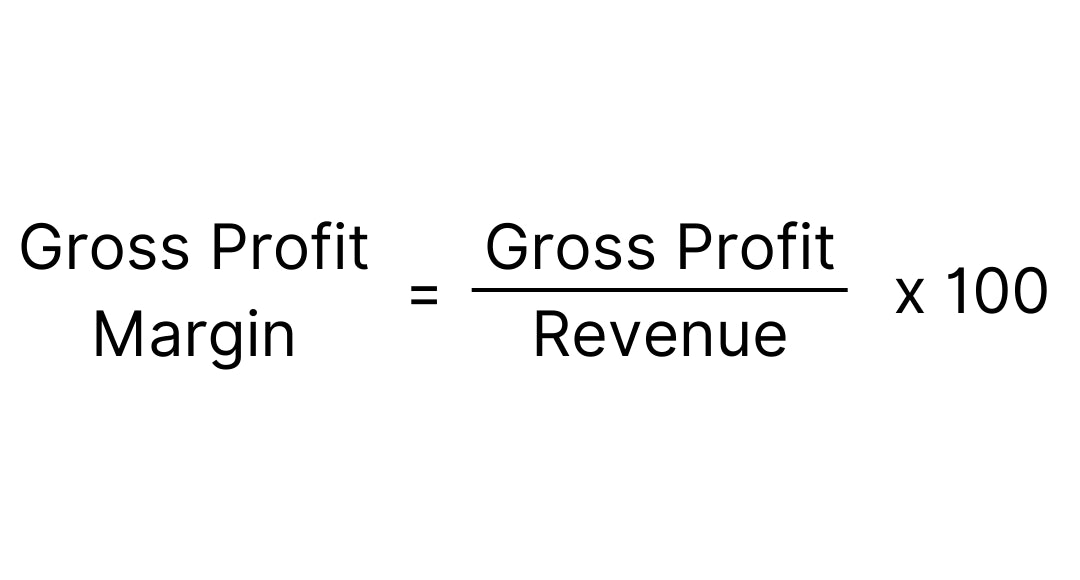

Gross Profit Margin

The gross profit margin measures the percentage of revenue that is left after deducting the cost of goods sold (COGS). A high gross profit margin indicates that your business is generating enough revenue to cover your costs and make a profit. To calculate your gross profit margin, divide your gross profit by your revenue and multiply by 100.

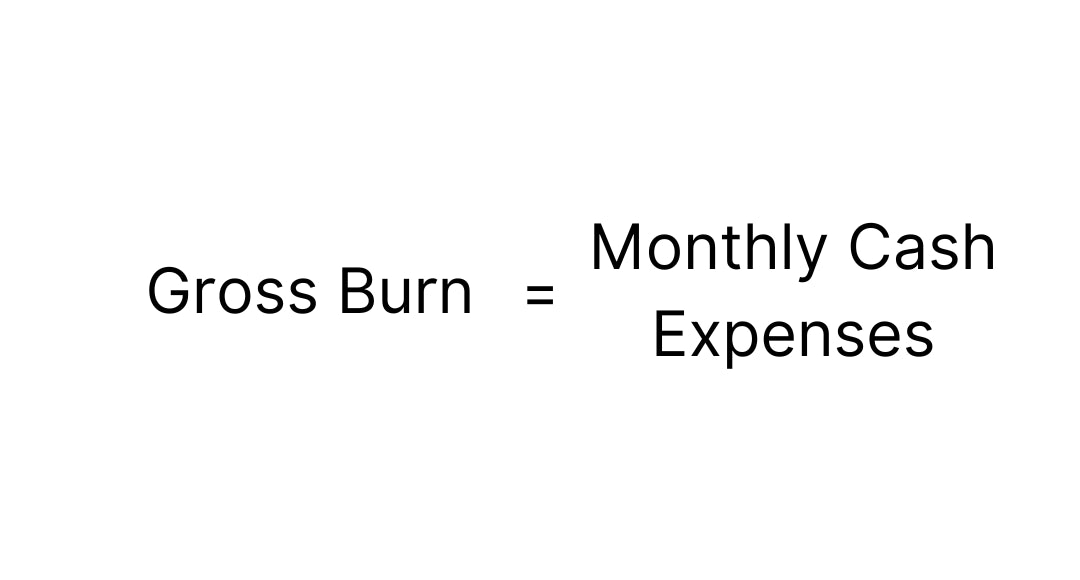

Gross Burn, Net Burn, and Runway

Gross burn is a metric that measures the total amount of money a company is spending per month over a given time period, including both fixed and variable costs such as salaries, rent, and other operating expenses. Gross burn does not take into account any revenue that the company may be generating.

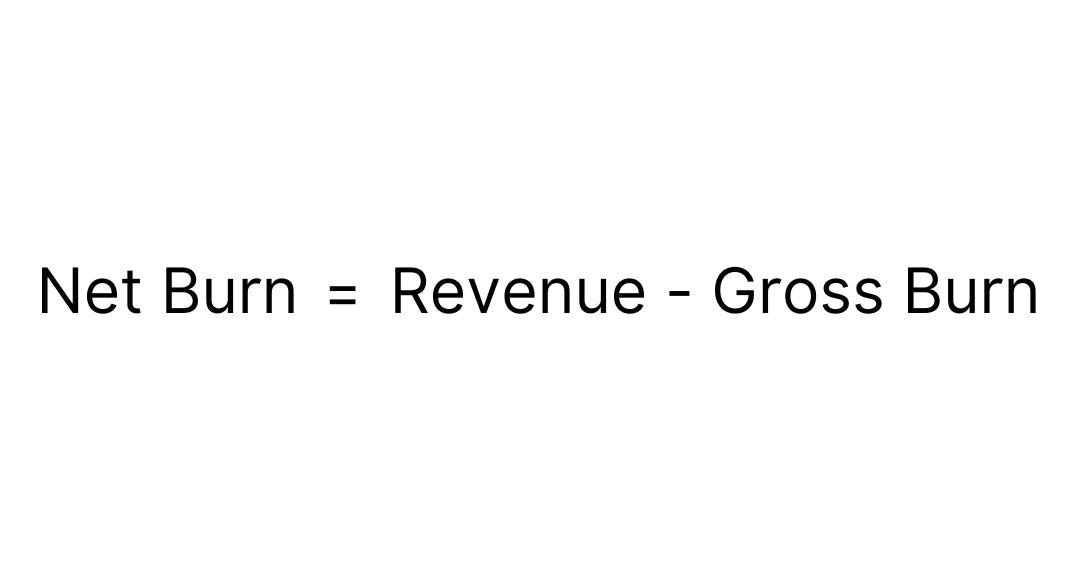

On the other hand, net burn is a metric that measures the amount of cash a company is losing per month, after factoring in any revenue it may be generating. Net burn is calculated by subtracting the company's monthly revenue from its gross burn. A negative net burn indicates that a company is generating more revenue than it is spending, while a positive net burn indicates that it is spending more than it is earning.

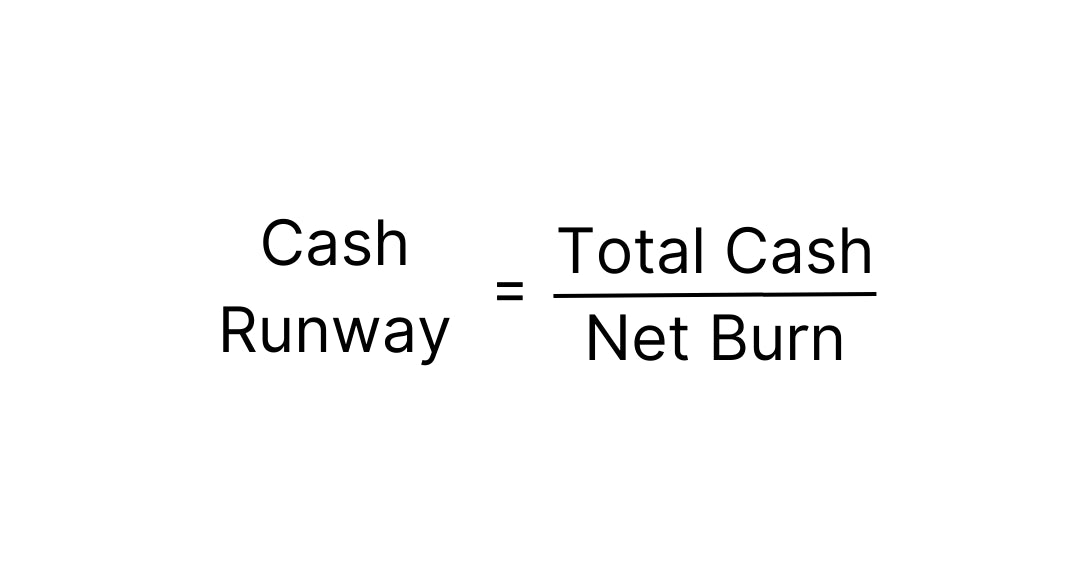

We can use the net burn calculation to calculate our cash runway, which shows the number of months you can continue operations before exhausting your total cash reserves. For startup founders, understanding the cash runway can help make decisions about when to begin a new fundraising round, or begin focusing on profitability. Cash runway is calculated by dividing your total cash by your net burn.

Both gross and net burn are important metrics for startup founders to track. Gross burn helps to understand the company's overall cash outflow, while net burn provides a more accurate picture of the company's financial health by taking revenue into account. In turn, these metrics aid in calculating the cash runway. By tracking these metrics, founders can gain valuable insights into their company's financial performance and make informed decisions about budgeting, fundraising, and other strategic priorities.

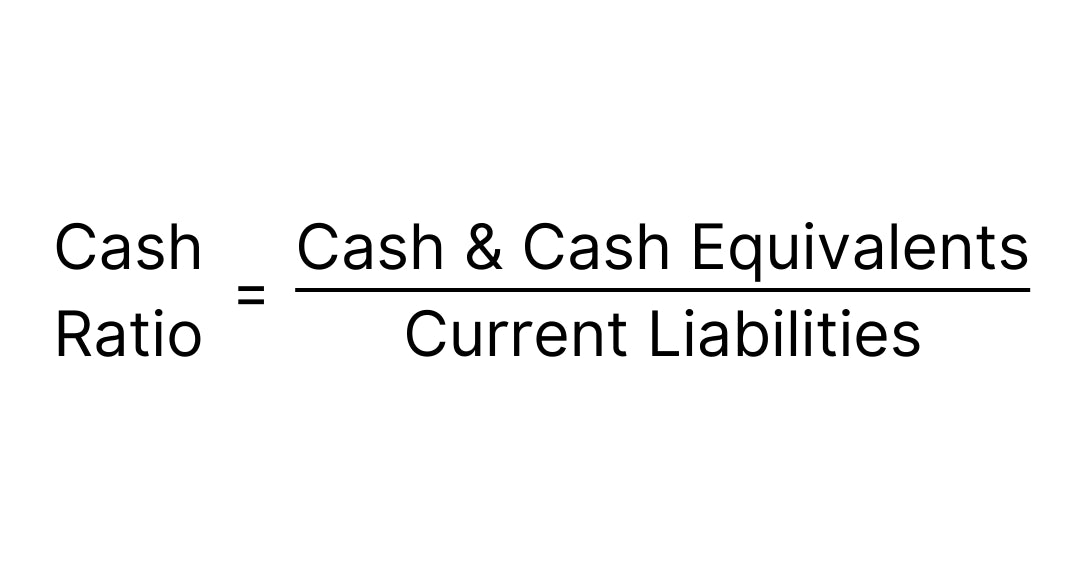

Cash Ratio

The cash ratio measures your business's ability to pay its short-term debts. It's calculated by dividing your cash and cash equivalents by your current liabilities. A high cash ratio indicates that your business has enough cash to pay its debts and is in a strong financial position.

Customer Acquisition Cost (CAC)

The CAC measures how much it costs your business to acquire a new customer. To calculate your CAC, divide your total sales and marketing expenses by the number of new customers acquired in a specific time period. A high CAC may indicate that your business needs to find more cost-effective ways to acquire new customers.

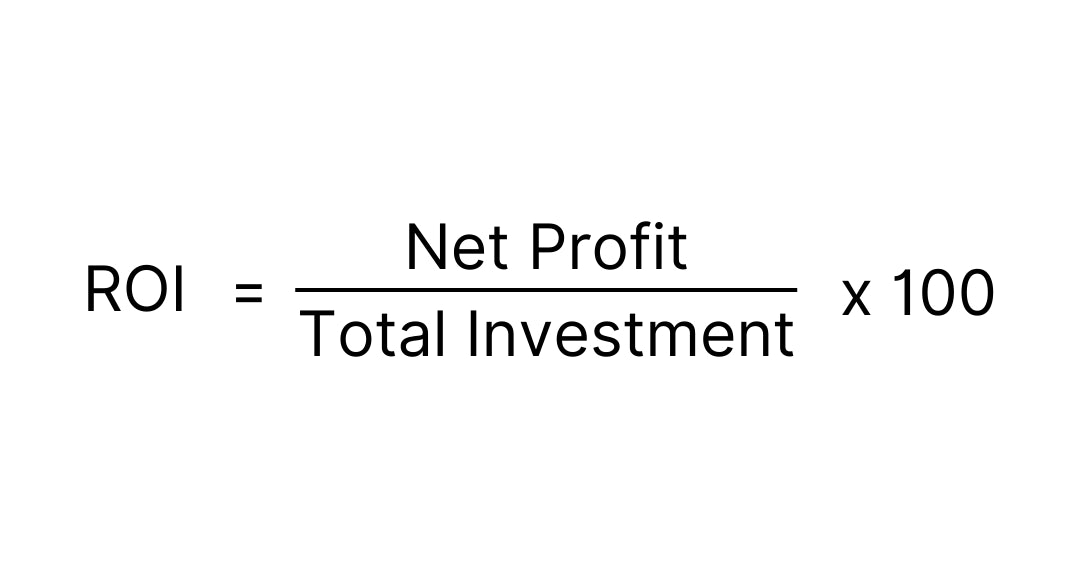

Return on Investment (ROI)

The ROI measures the profitability of an investment. To calculate your ROI, divide your net profit by your total investment and multiply by 100. A high ROI indicates that your business is generating a positive return on its investments.

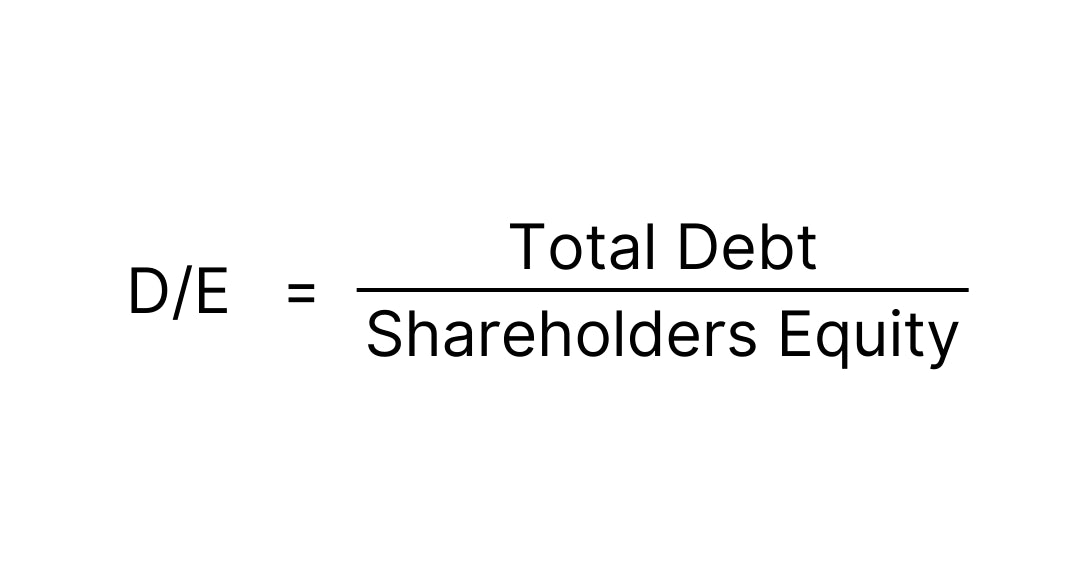

Debt to Equity Ratio (D/E)

This ratio measures a company's financial leverage by comparing its total debt to its total equity. A higher debt-to-equity ratio indicates that a company is using more debt to finance its operations, which can increase its risk. This ratio is calculated by dividing your total debt by your shareholder equity.

Automate your financial ratios

FP&A tools like Pry allow you to understand your current financial ratios and build valuable forecasts to see how these values are expected to change over time. Save time, reduce manual errors, and gain valuable insights into your financial performance by automating the calculation process and providing real-time insights with Pry, startups can make informed decisions about their financial health and take steps to improve it.

Ready to make informed decisions about your financial health? Book a demo with our team here.