Building a Financial Dashboard

As a startup founder, it's important to have a clear understanding of your business's financial performance. A financial dashboard can be a valuable tool for tracking key metrics and making informed decisions about your business's finances. Here’s the Pry playbook on what a financial dashboard is, why it's important, and how to build one.

What is a financial dashboard?

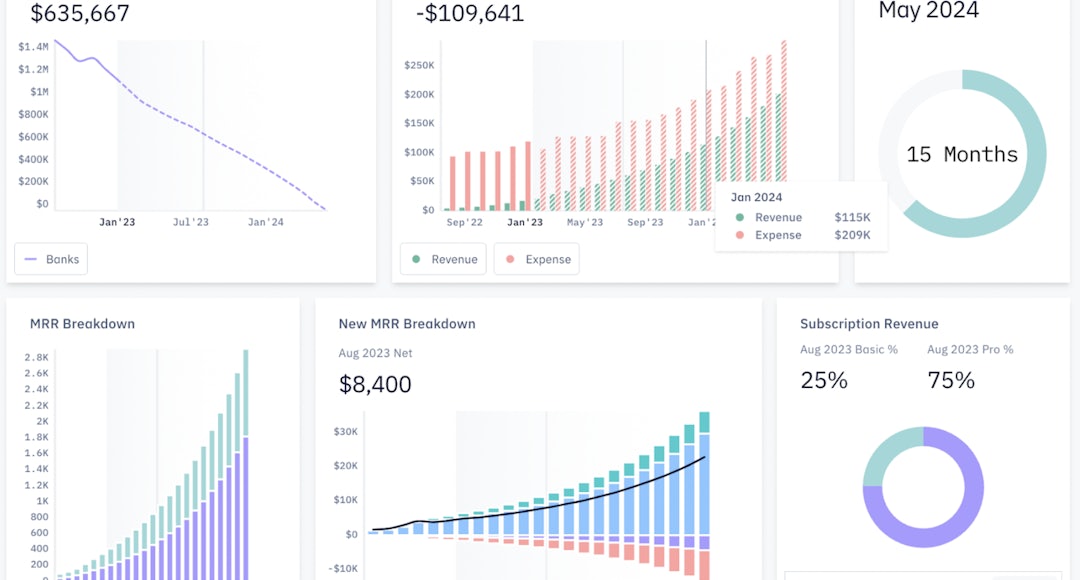

A financial dashboard is a visual representation of your business's financial performance, often in the form of charts, graphs, and other visualizations. A financial dashboard can provide an at-a-glance view of your business's finances, allowing you to quickly see how you're doing and identify any trends or issues.

Why is a financial dashboard important for startups?

A financial dashboard can be a valuable tool for startups for several reasons:

Improved decision-making: By providing an at-a-glance view of your business's finances, a financial dashboard can help you make informed decisions about how to allocate resources, manage expenses, and grow your business.

Increased transparency: A financial dashboard can provide increased transparency into your business's finances, making it easier for stakeholders to understand how the business is performing and where resources are being allocated.

Better planning: A financial dashboard can help you plan for the future by providing historical data and trend analysis, allowing you to anticipate future expenses, revenues, and cash flow needs.

Enhanced collaboration: A financial dashboard can be a valuable tool for improving collaboration within your team. Providing a centralized view of your business's finances, it can help your team work together more effectively to achieve financial goals.

Real-time monitoring: A financial dashboard provides real-time information about your business's finances, allowing you to quickly identify and address any issues or discrepancies.

How to build a financial dashboard

Building a financial dashboard is a process that involves several steps, including:

Choose the right metrics: Based on your goals, choose the metrics that are most relevant to your business. This may include revenue, expenses, cash flow, profitability, and other key financial metrics.

Gather your data: Gather the data you need to populate your dashboard. This may include financial statements, budgets, and other financial reports. Make sure the data is accurate and up-to-date, as this will ensure that your dashboard provides a reliable and accurate representation of your business's financial performance.

Build your dashboard: Once you have chosen your software, build your dashboard. Start by creating a layout that makes it easy to understand and navigate the information. Then, populate the dashboard with the data you have gathered, and create visualizations and analysis tools to help you interpret the information.

Refine your dashboard: Once your dashboard is deployed, you may find that there are areas for improvement. For example, you may need to add new metrics, modify the visualizations, or change the layout. Regularly review and refine your dashboard to ensure that it continues to meet your needs and provide the information you need to manage your business's finances effectively.

Tools like Pry were built to help founders streamline these steps to get their financial dashboard up and running faster. Easily create interactive dashboards full of beautiful charts backed by your real-time financial data.

Overall, a financial dashboard is a valuable tool for startups. It provides a clear and concise view of where you’ve been and where you are trending. With the right financial dashboard, you can make informed decisions, plan for the future, and monitor your financial performance in real time.