The Good, Better, and Best Ways to Calculate Startup Runway

You’re the pilot in an airplane, about to take off. The engine is purring, and the airport is sliding past your window as the plane speeds up. Then you look down at the runway. It’s going to end before you can get your plane in the air. Do you stay in the plane and maintain your current speed? Do you speed up, so your plane takes off before the runway ends? Or do you bail before you crash?

A startup’s cash runway is similar. If you know your runway will end in a couple of months, you obviously need to do something. You don’t want your company to crash and burn, and every potential investor will ask you about it. So you should be comfortable calculating and discussing your runway at any time.

According to Tim Brady, a partner at Y Combinator and a co-founder and partner at Imagine K12, startup founders should check their runway every week. But here’s the thing: the way most people calculate startup runway can be inaccurate and misleading. Below we’ll explain a more useful way to calculate startup runway.

What is startup runway?

ICYMI, “runway” is the number of months your startup can survive before running out of cash. Runway is an important metric because it gives you insight into how long your company will stay alive.

In the startup world, a runway chart helps answer questions like: Do I need to adjust my business model? Do I need to throttle spending? Do I need to raise more capital?

Of course, the most accurate way to predict a startup’s future also requires the most work: building a full financial forecast. To do this, you would need to estimate the amount of cash coming in and going out on a monthly basis and then make a monthly financial forecast based on those estimates. Most forecasts lead to profitability and infinite runway, so they show that your cash never hits zero.

But sometimes, you need a quick estimate of how long your company can continue on its current path. Maybe you need to make a pitch to investors, or you simply need to make day-to-day decisions. That’s what startup runway calculations are for.

What do you need to calculate runway?

Every runway calculation will take into account your bank account balance and your cash burn rate. Burn rate is the measurement of your company’s monthly net cash flow.

To calculate your monthly burn rate, take all the cash that’s going out in a month and subtract all the cash that’s coming in. If a customer agrees to buy your product but won’t pay you until next year, don’t include that in your burn rate.

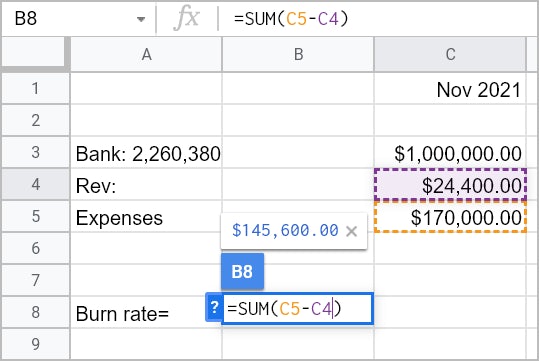

Here’s the formula to calculate burn rate:

Net burn rate = expenses – revenue

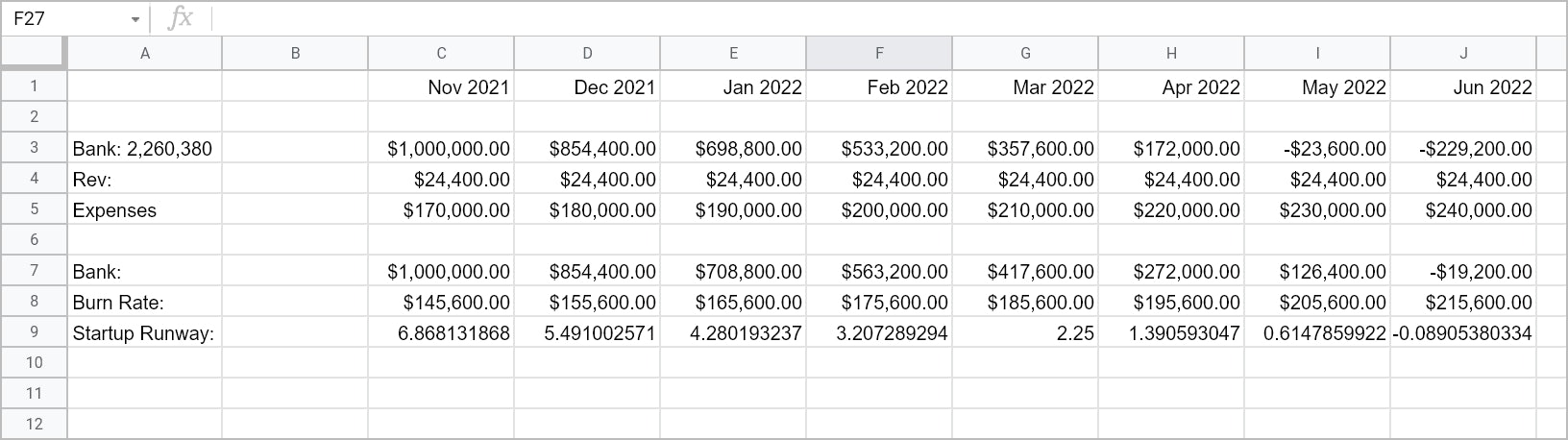

For example, if your company spent $170,000 and brought in $24,400 in revenue last month, your burn rate would be $145,600.

In Excel, it looks like this:

Good: The traditional runway calculation

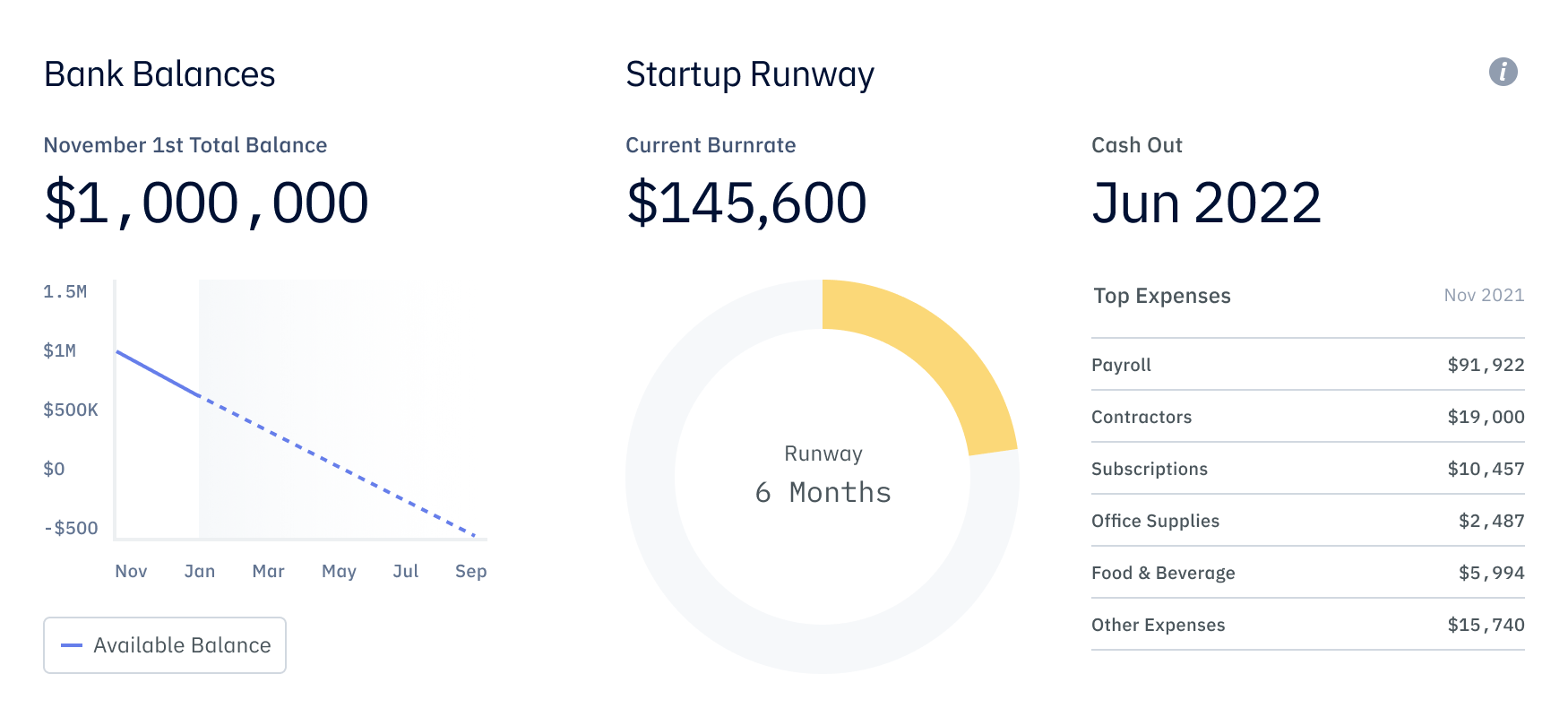

The traditional way to calculate startup runway is a quick snapshot based on last month’s numbers. It’s valuable to show investors because it reflects your current state of affairs before they’ve given you any money. This calculation assumes that expenses and revenue will stay constant.

Of course, a startup’s actual operations are more complicated. Expenses fluctuate, and so does the amount of cash coming in. Because the traditional runway calculation doesn’t take these fluctuations into account, it isn’t the most useful calculation for startups. But we’ll get to the more useful runway calculations in a moment. For now, you can provide that quick runway answer for investors by taking the amount of cash in your bank account and dividing it by your burn rate.

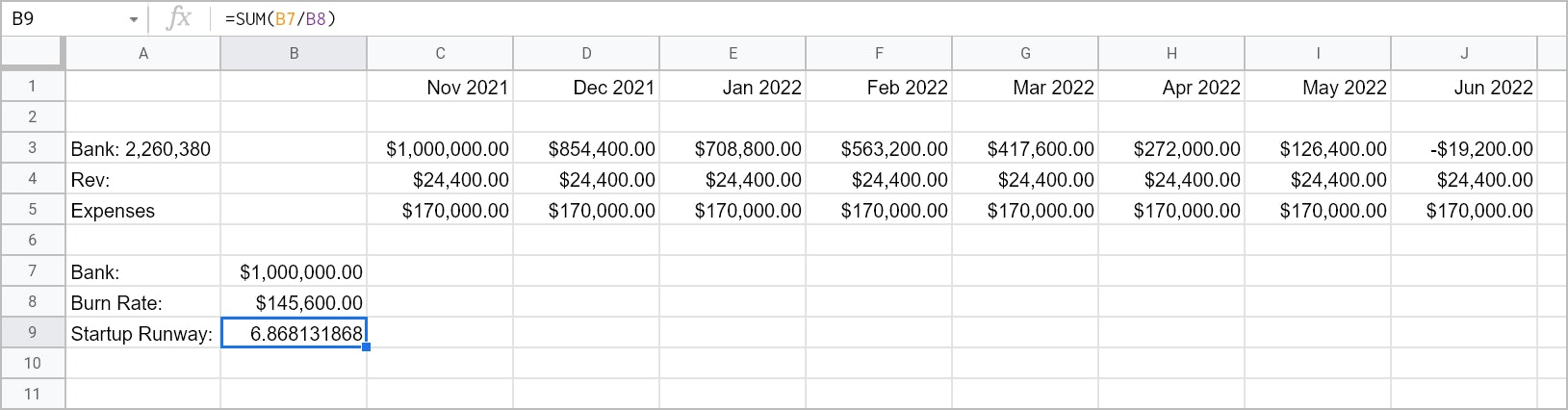

Here’s the formula to calculate startup runway the traditional way:

Startup runway = cash balance / burn rate

For example, if you have $1,000,000 in your bank account, and your burn rate is $145,600, then your runway is six months.

In Excel, it looks like this:

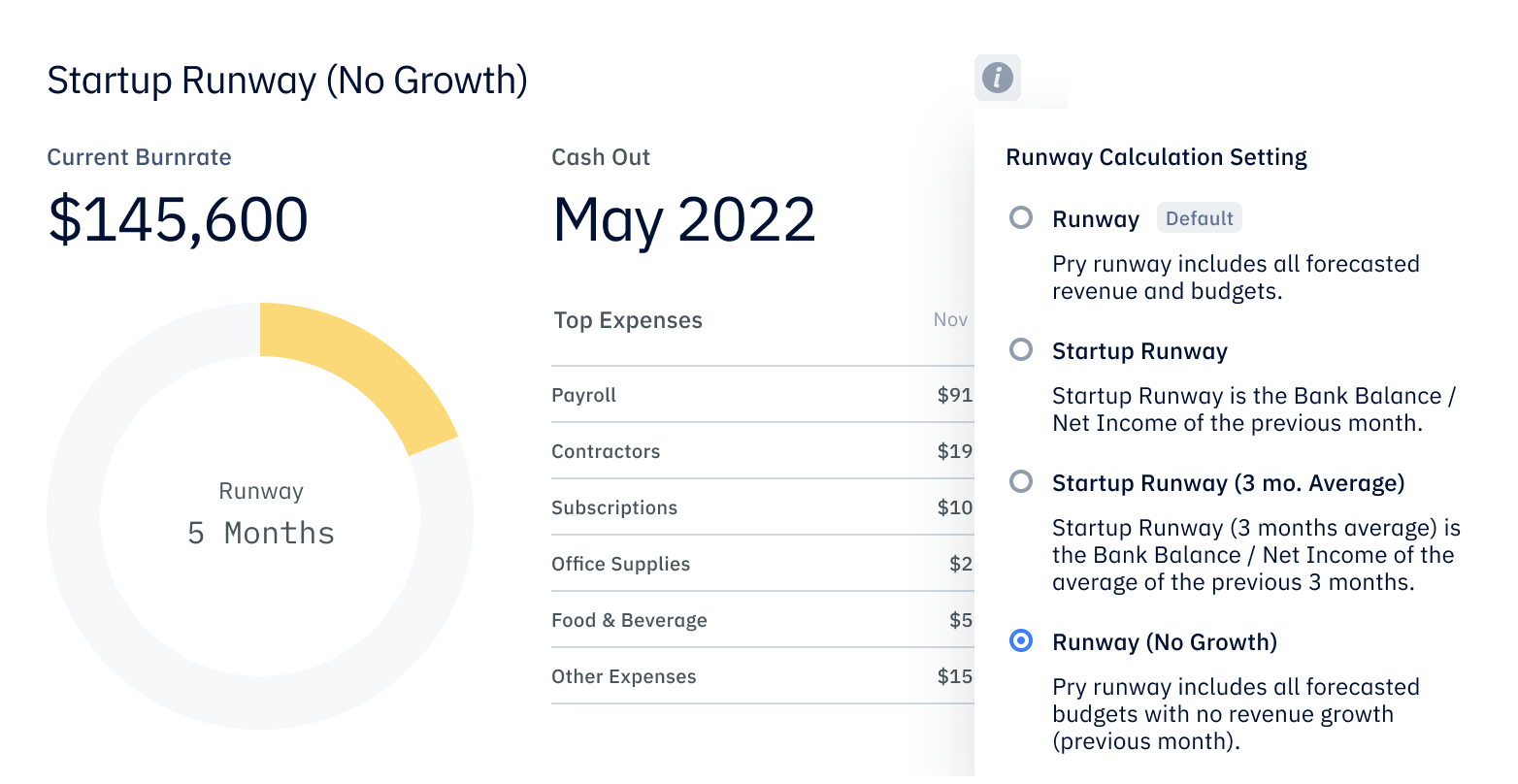

In Pry, it looks like this:

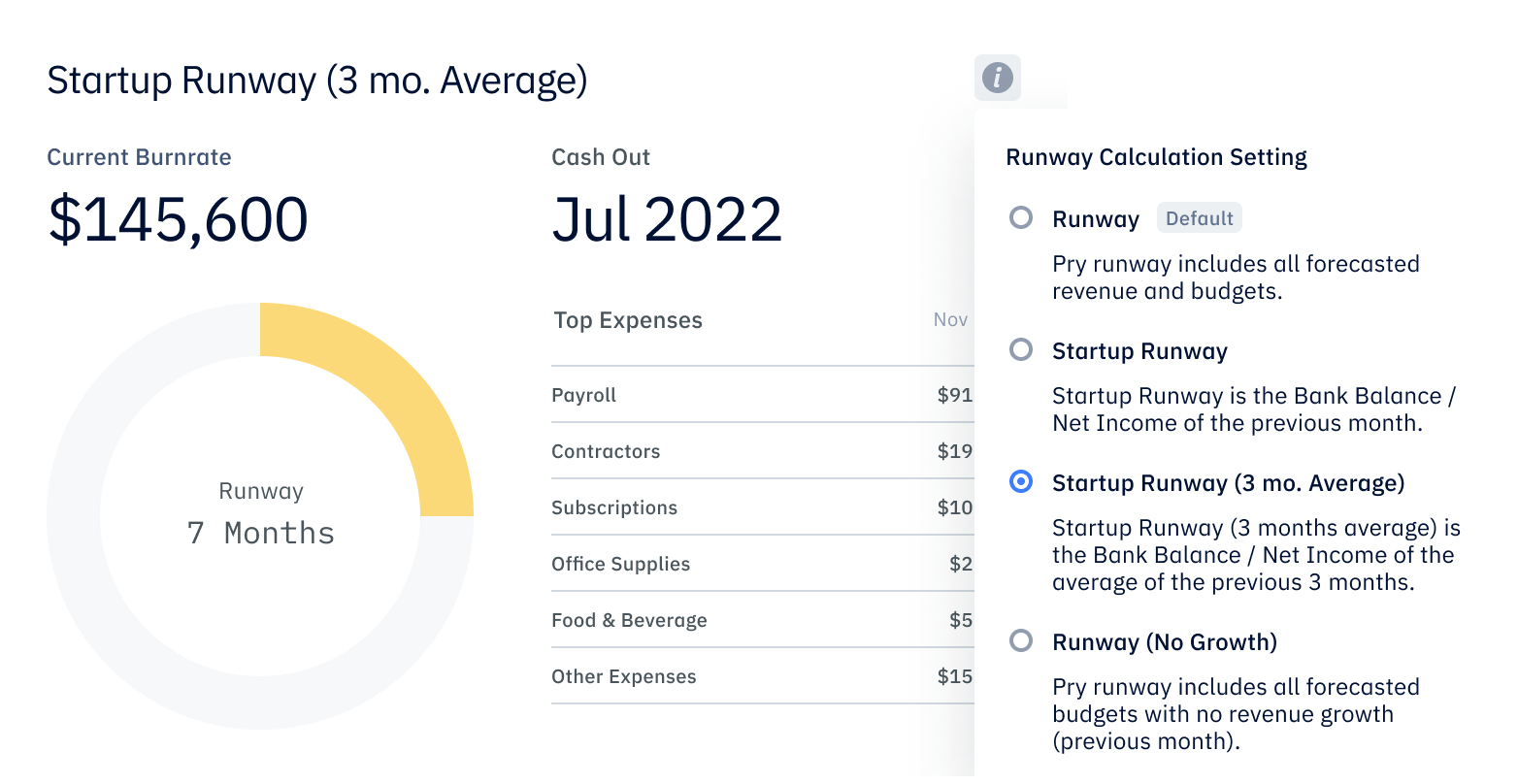

Better: A 3-month average

Runway calculations can be done based on three-month averages instead of just last month’s burn rate. This is a good option if you don’t have a finance team because it takes into account some fluctuations but doesn’t take a long time to calculate.

Pry can project this number for you very quickly without any extra calculations. You simply select a different option in the dashboard, and it generates automatically.

In Pry, it looks like this:

Best practice: Assume expenses grow but revenue won’t

The challenge with the runway calculations above is that most companies tend to over-forecast revenue but not expenses. That may be useful for an investor pitch, but it’s not very useful for operations.

In reality, your company may not grow as fast as you want, but your expenses will keep increasing. You’ll hire more people, so salary costs and office rent will go up over time. And you need to quickly calculate runway so you can make everyday decisions that affect your company.

The most useful way to calculate runway is to assume your company’s expenses will grow but revenue won’t. Then see how many months you would have left. At Pry, that’s called the No Growth Runway. It’s a conservative estimate that can help early-stage startups avoid operational errors.

For example, let’s say your cash balance is $1,000,000, and your burn rate is $145,600. You estimate your expenses will increase by $10,000 every month, but your revenue will stay the same. That means your runway is only five months (vs. six months if you calculated it the traditional way).

In Excel, it looks like this:

In Pry, it looks like this:

How many months is enough runway?

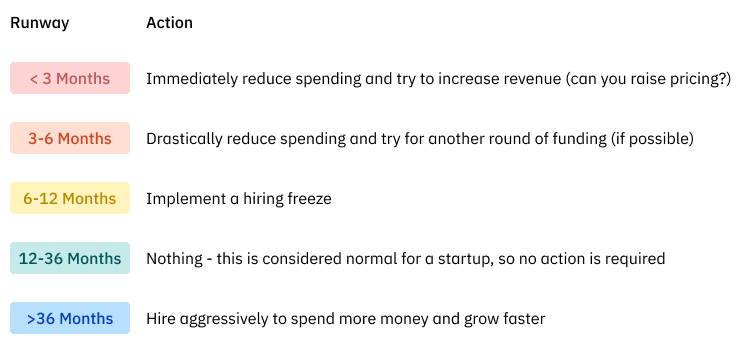

Startups need to take different actions depending on how much runway they have left. After your first round of fundraising, you should aim for 24 months of runway. Keep in mind that another fundraising round may not be an option for startups with less than six months of runway. That’s because it shows your company is not profitable — in fact, it’s failing.

If a runway estimate shows your startup has three to six months left, you might be able to avoid doomsday by making more money and cutting operating costs. That’s the advantage of the conservative approach to runway — it’ll give you more of a warning to change course before it’s too late.

“Plenty of successful startups have passed through near-death experiences and gone on to flourish. You just have to realize in time that you're near death.” — Paul Graham, co-founder of Y Combinator

Here are the different runway milestones and what you should consider doing at each stage:

Avoid the near-death experience with a conservative approach

You need to keep a watchful eye on your runway in order to avoid crashing your startup. And now that you know how to calculate it, you can take action sooner to adjust spending and hopefully avoid the near-death experience altogether.

Pry can help you calculate your startup runway by quickly giving you a conservative runway estimate based on the assumption that revenue won’t grow, but expenses will. Read more about how Pry’s intuitive tool gives customers greater insight into their cash position. Or check out Pry’s Runway Chart Settings to weigh the pros and cons of each way to calculate runway.