Why Do Startups Need to Departmentalize Expenses?

Startup expenses can be broken into four major categories — the cost of goods sold (COGS), sales and marketing (S&M), general and administrative (G&A), and research and development (R&D). Taken together, they add up to the total expenses on your income sheet.

But should a startup lump together all business expenses without categorizing them? No. In fact, this is a costly mistake.

Departmentalizing expenses can keep startup founders in control of their expenses

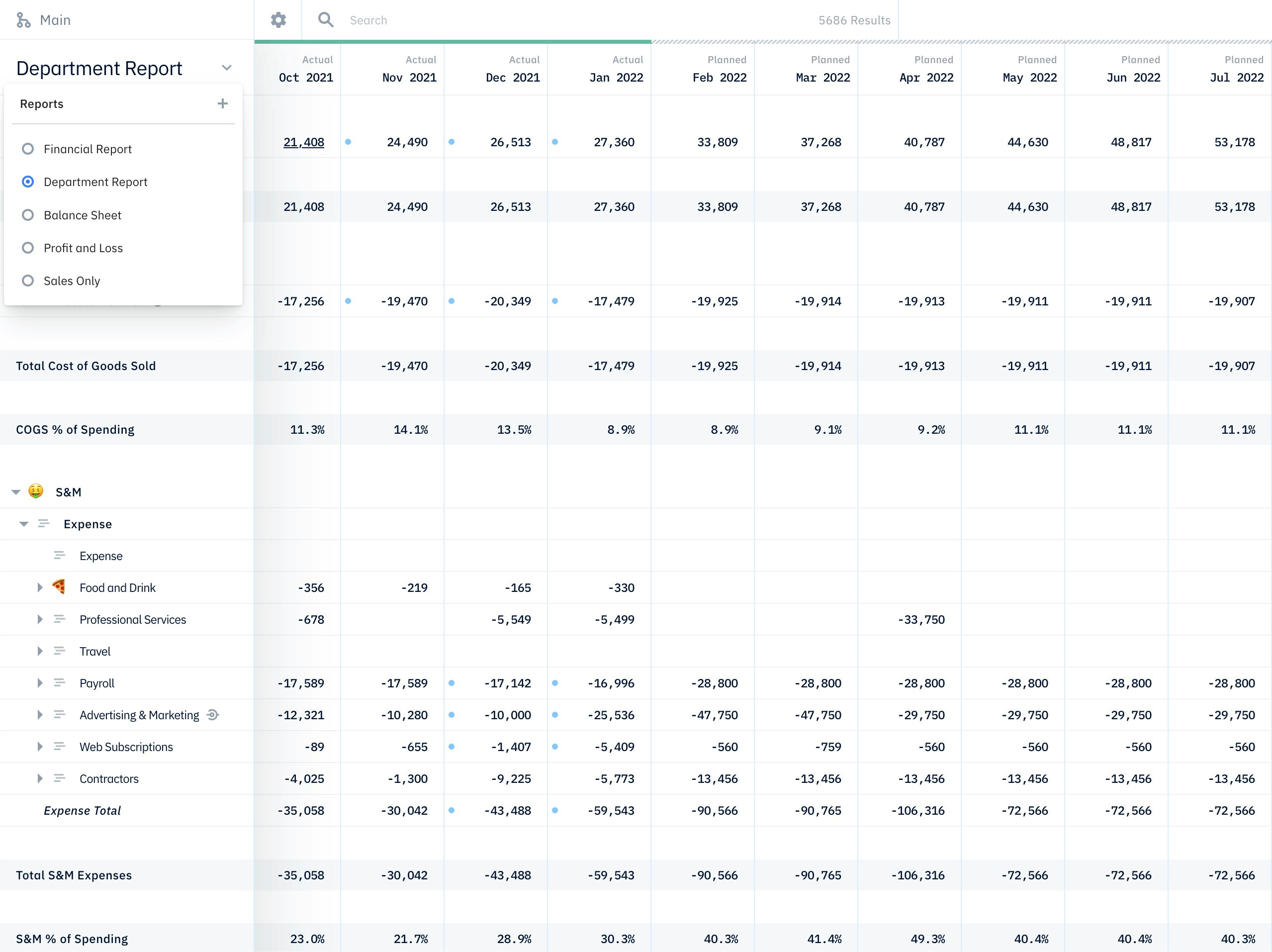

Using software to departmentalize expenses allows founders to see a breakdown of all business expenses in one place. This helps startup founders to periodically measure, manage, and review their startup expenses as effortlessly as possible.

Most bookkeepers can help you classify expenses and transactions by department. You'll just need to ask them for this service. However, relying on bookkeepers to do this from scratch may cost you more time and money than needed. Even more importantly, you (and your co-founders) will understand what expenses are essential to the startup more than any external bookkeeper. So, it's a good idea to use software and lay the framework to track your startup expenses.

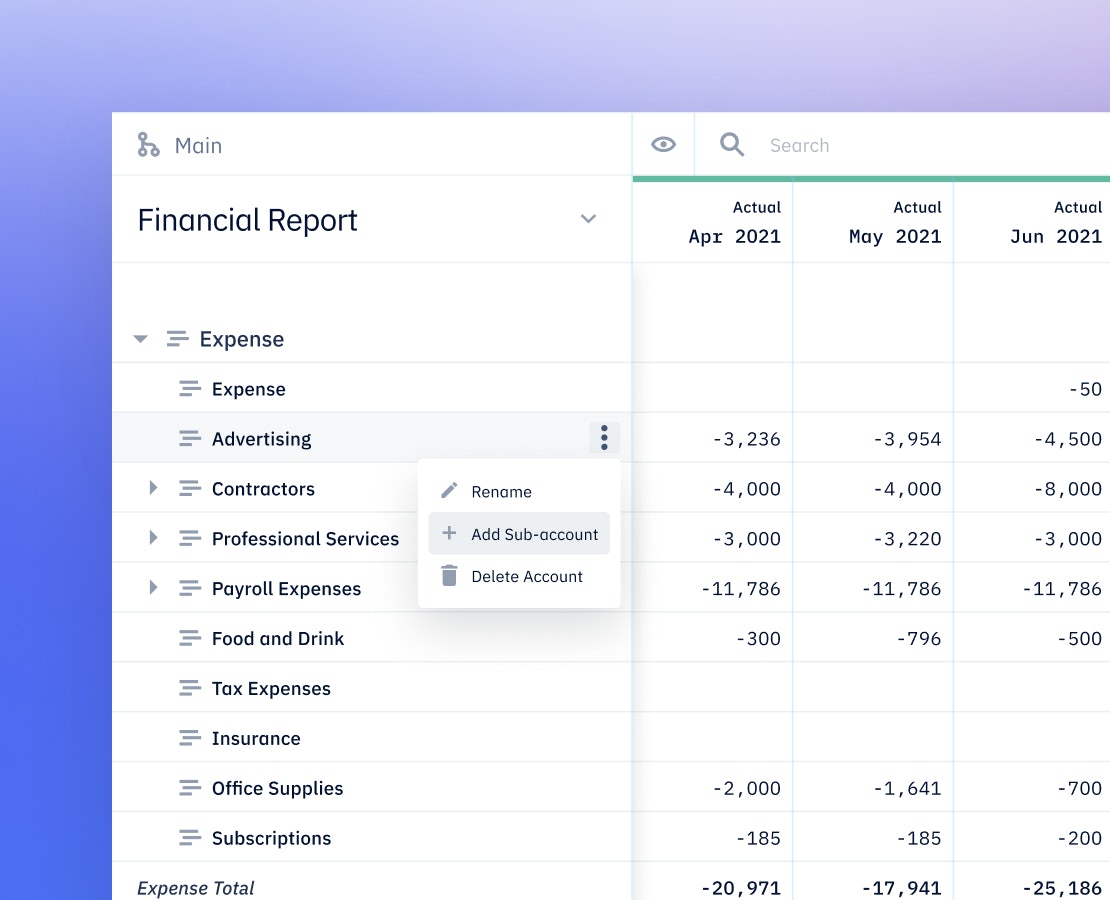

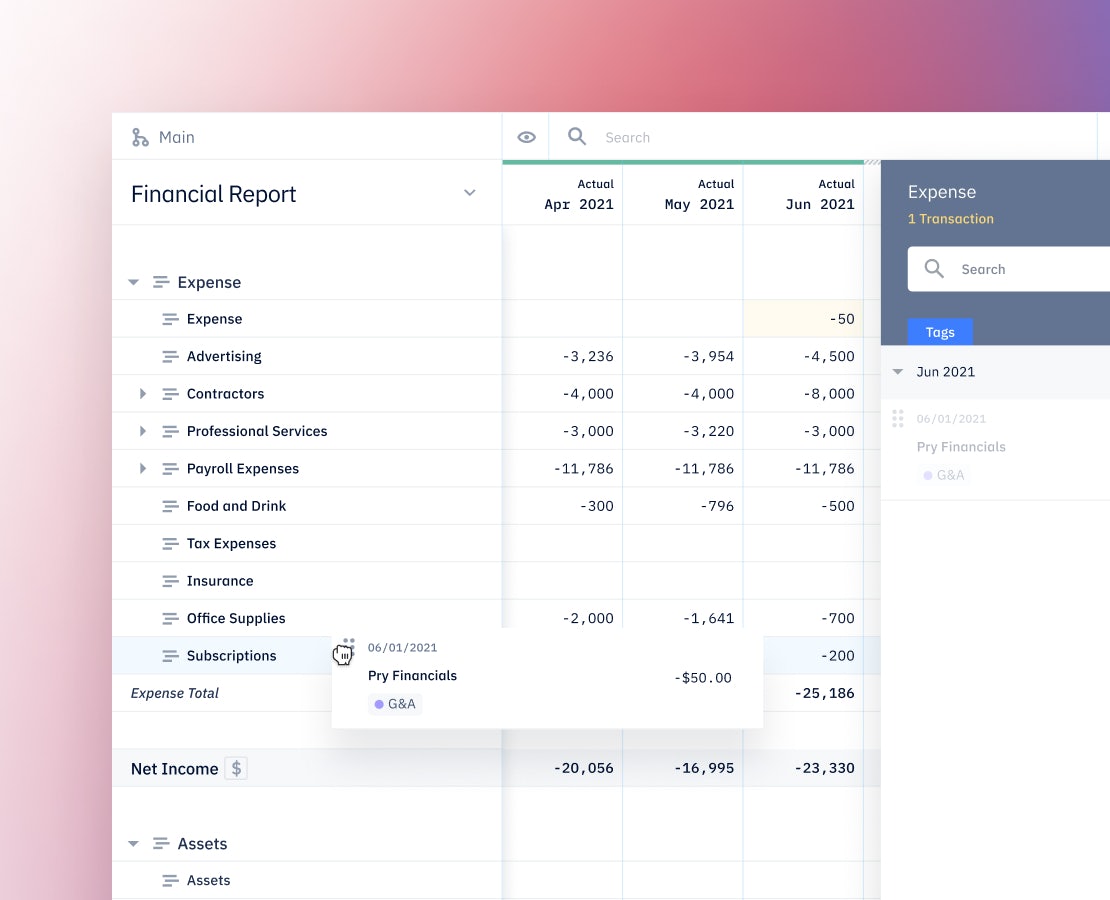

For example, a finance software like Pry can automatically categorize all your monthly expenses by each department and give you a monthly report. This allows you to drill down each department expense into more granular subcategories.

At a practical level, to departmentalize your startup expenses, you’ll need to categorize each expense into sub-accounts under each department. For example, instead of lumping together all software and hardware expenses into G&A, you would instead break them down further into R&D-related hardware expenses and marketing-related software expenses. With Pry, you can tag all your startup expenses by departments, projects, or custom tags as and when they occur. This means that you don’t have to lump all your expenses together and wait for your bookkeeper to categorize them every quarter.

Departmentalizing expenses can give founders key information to create metrics and understand their business

Without departmentalizing your expenses, you can’t effectively keep track of expenses, save on taxes, or calculate important financial metrics that your investors care about.

“All founders should know what your startup numbers (income and expenses) are. Because an external bookkeeper isn’t going to understand your business as well as you do,” says Kirsty Nathoo, CFO at Y Combinator. Startup founders need to keep track of income and expenses because they determine how much runway your startup has before it runs out of cash.

But most founders hate tracking business expenses because they are focused on increasing user growth (as they should be). However, investing a few minutes in departmentalizing your startup expenses and reviewing them periodically can help you identify all tax-deductible and unnecessary expenses. It can also help your bookkeeper and CPA present your finances accurately as you scale.

Yes, it is hard for founders to don multiple hats. But your finances aren’t something that can be fully delegated or outsourced. “The best founders always have the key [startup] number and KPIs at their fingertips and are heavily involved in calculating them rather than outsourcing them,” says Kirsty.

More importantly, departmentalizing startup expenses can help you calculate important startup metrics that help your team, advisors, and investors better understand how your startup is growing. For example, to calculate your startup’s customer acquisition costs (CAC), you need to divide S&M expenses by the number of customers acquired. You’ll have no trouble calculating these financial metrics if you have departmentalized expenses. If not, you could end up frantically digging up numbers from a pile of uncategorized expenses at the last moment just before an important investor presentation.

Departmentalizing your expenses is about more than saving taxes or calculating metrics; it’s about understanding your company. As Jeff Jordan, Anu Hariharan, Frank Chen, and Preethi Kasireddy point out in this Andreessen Horowitz article, “Good [startup] metrics aren’t about raising money from VCs — they’re about running the business in a way where founders know how and why certain things are working (or not)… and can address or adjust accordingly.”

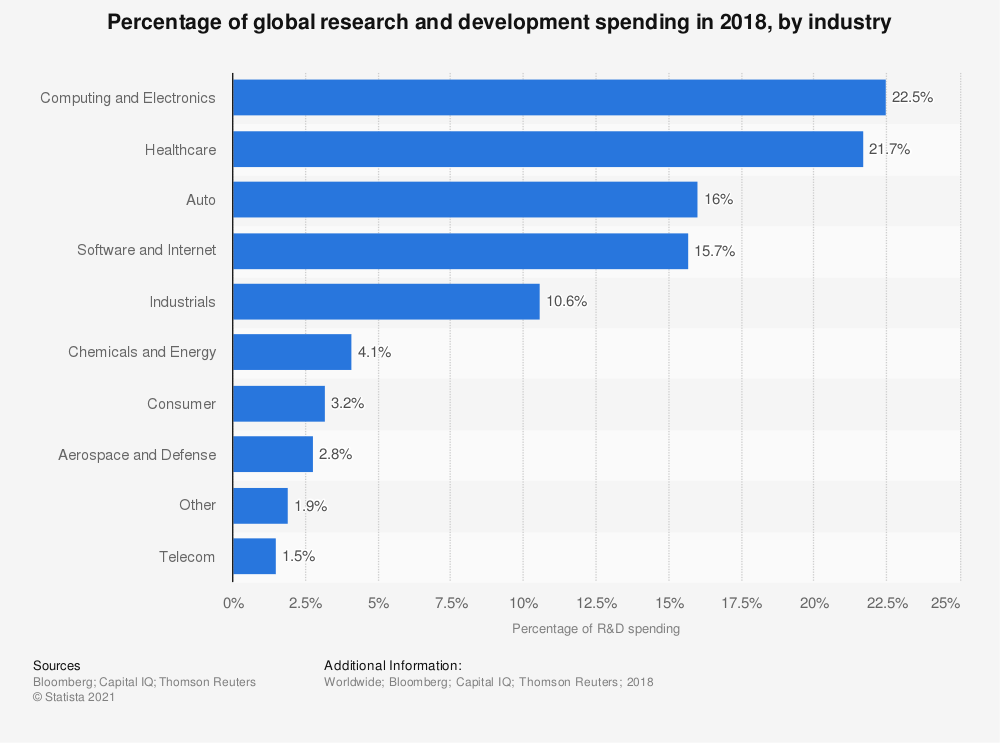

Departmentalized expenses can be compared to industry benchmarks and highlight core competencies

Based on their industry and business model, different startups will have different cost structures. Departmentalizing your expenses into COGS, S&M, G&A, and R&D offer opportunities to compare them against industry benchmarks. This can help you identify what is working well and what isn’t.

Since your department expenses add up to your total expenses, one department will have more expenses than the others. For example, in the early stages of a technology startup's life, most expenses would be in R&D. This may indicate that the startup is still developing its core technology or product offering. However, this may change over time as the startup matures and scales. The same startup, after finding product-market fit, may then begin to invest heavily into S&M to aggressively grow their users and revenues. And at a later stage, once it acquires significant market share, it may invest more into G&A to pay for a management team that can take the company to new heights.

At every stage, your startup can compare its expenses against your industry benchmark data. An early-stage nanoelectronics or blockchain startup may want to show how it is investing in X technology and why its R&D expenses (higher than industry benchmarks) can give the startup a competitive advantage or a defensible moat. This may help justify higher valuations.

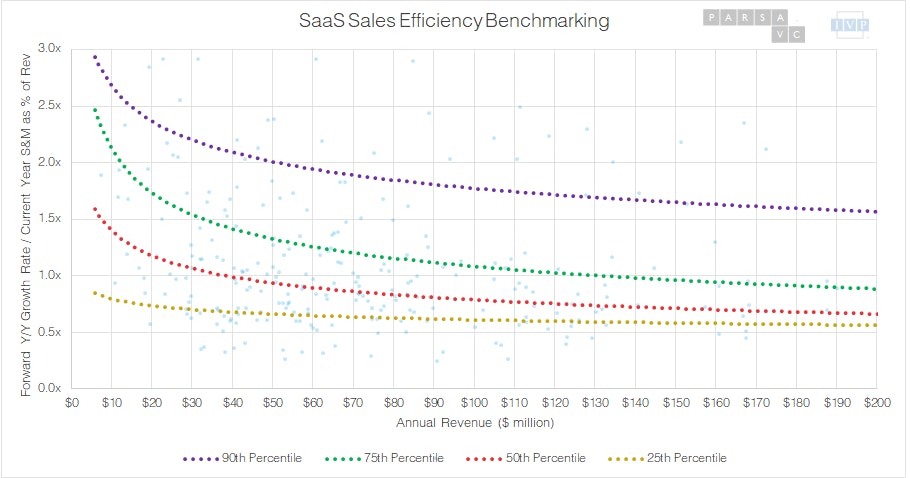

However, if you’ve found a product-market fit and you’re looking to raise a round of investments to fuel growth, then you may want to change the narrative from R&D investments to how effectively your startup is growing. For example, you may want to show how your S&M expenses create more user and revenue growth. Or you may want to showcase how your self-serve model is bringing in organic growth and how this results in lower S&M expenses compared to industry benchmarks. You can make an even stronger case by comparing your S&M and revenue growth numbers against other SaaS companies. This information can highlight your competitive advantage and make a compelling case for investors.

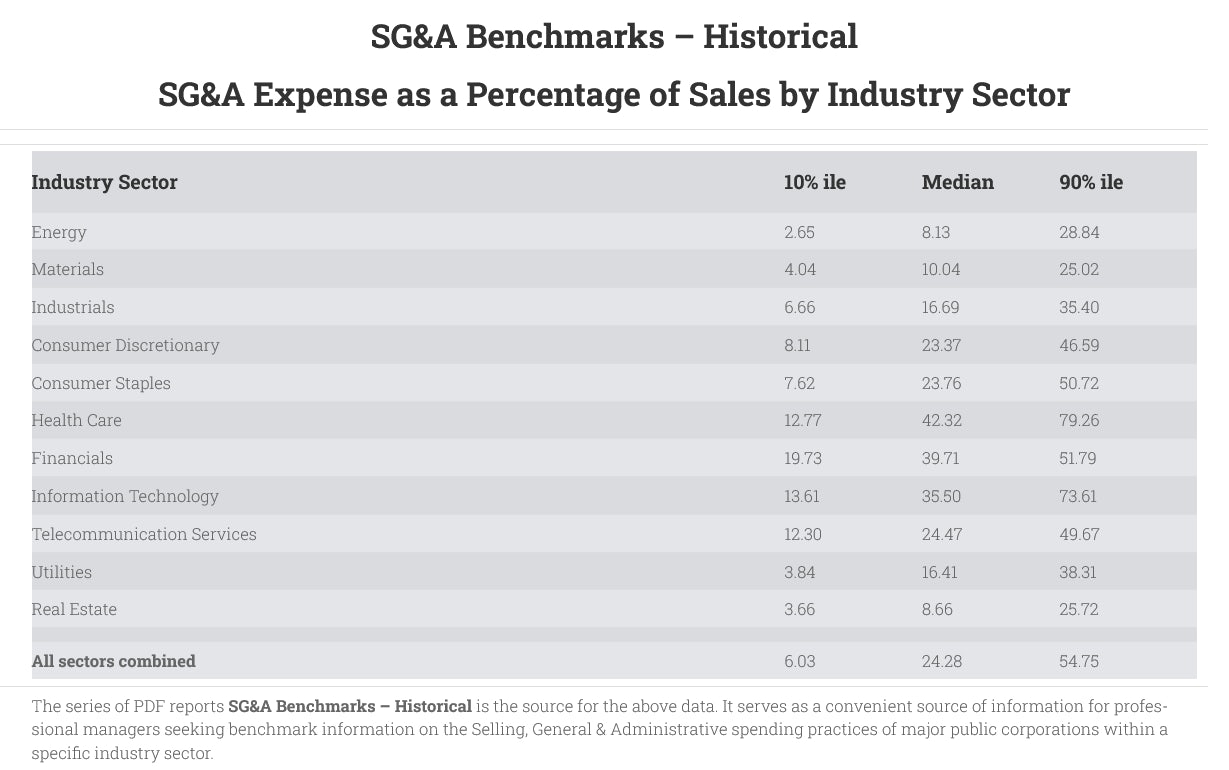

Further down the startup cycle, when you begin to have significant G&A expenses, you may want to compare that against industry benchmarks. Do you have higher or lower G&A expenses than the median? Use this opportunity to highlight why your G&A expenses are a good idea in the long run for your business.

Because the sum of your COGS, S&M, R&D, and G&A department expenses make up your total business expenses, one department is going to have more expenses than another. Departmentalized expenses turn the problem of high expenses into an opportunity to highlight why each department has higher or lower expenses and why this is good for the business.

In broad strokes, here are a few indicative department expenses and corresponding narratives:

- High R&D spending that is above 30% of total expenses shows significant product investment.

- High S&M spending that is above 30% of total expenses shows aggressive investment in growth.

- Low G&A spending that is less than 15% of total expenses means low overheads and efficient management.

- COGS would vary depending on the nature of your business; for example, <20% for tech and <70% for services.

Departmentalized expenses can help you make informed business decisions

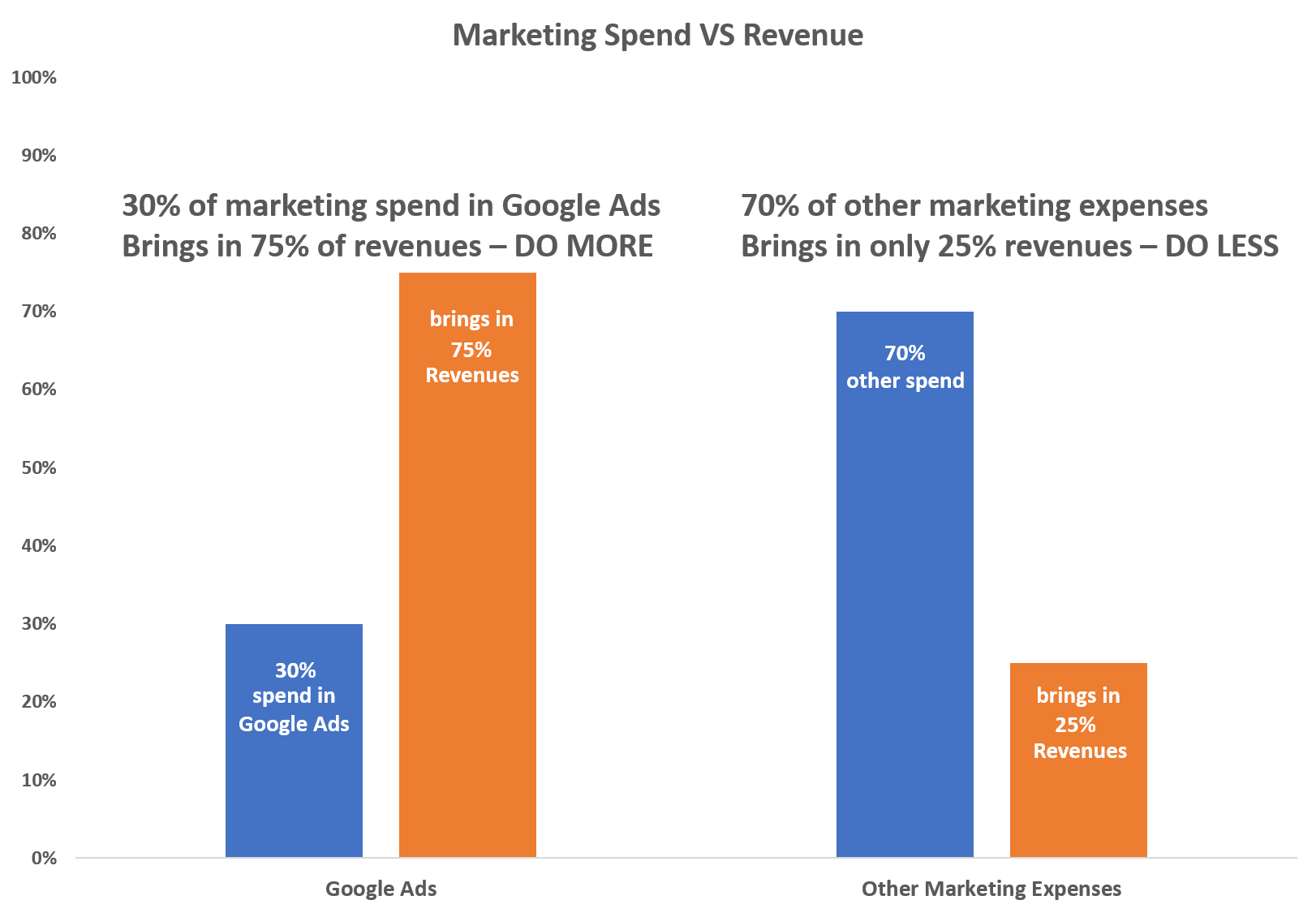

By departmentalizing your expenses, you can track and measure expense subcategories within each department. This can help you apply Pareto analysis to identify disproportionate results and make informed decisions on what works and what doesn't. For example, such an analysis can help you identify your most effective marketing channels.

Once you departmentalize your business expenses, you have the framework needed to create further expense subcategories. This can give you specific and actionable information. For instance, knowing that your monthly marketing spend was $10,000 last month isn’t too useful. However, understanding that 50% of your marketing went toward ads is useful.

A further breakdown of your ad spending may show that your marketing team invested $3,000 in Google Ads and $2,000 in Facebook ads. This information is even more useful because it allows you to compare those specific expenses with results. So, for example, if Google Ads brought in $7,500 worth of sales last month, then you can do more of that.

You can extend this line of thinking to other areas, such as cutting expenses or even hiring or retaining talent. For example, if you want to cut down on high G&A expenses and the insurance costs amount to 90% of your G&A expenses, you could possibly find other cheaper insurance providers.

You can also apply this departmentalized approach to hiring decisions by comparing labor costs to ROI. However, Kirsty cautions that calculating the value of individual contributors is more complex than other expenses on a spreadsheet. She says, “Startup founders should be conscious that every hire is actually an investment into the business and you should be making sure that you're getting a return on that investment. It's super easy to measure that you're not getting a good return on investment from that salesperson who's not bringing in more sales than it's costing the business to hire them. But also think about that community manager or support manager. It is much harder to measure their return on investment. But that's one of the things as a CEO you need to be looking at. You need to make sure that all the people in your company are actually working to make the company more valuable.”

Pry can help you departmentalize your startup expenses effortlessly

Departmentalizing expenses helps you manage finances because it allows for KPI-focused budgeting, department-level budgeting, and revenue recognition. And with automated tools designed specifically for startups, you can achieve all this without hiring an accountant or spending hours in Excel.

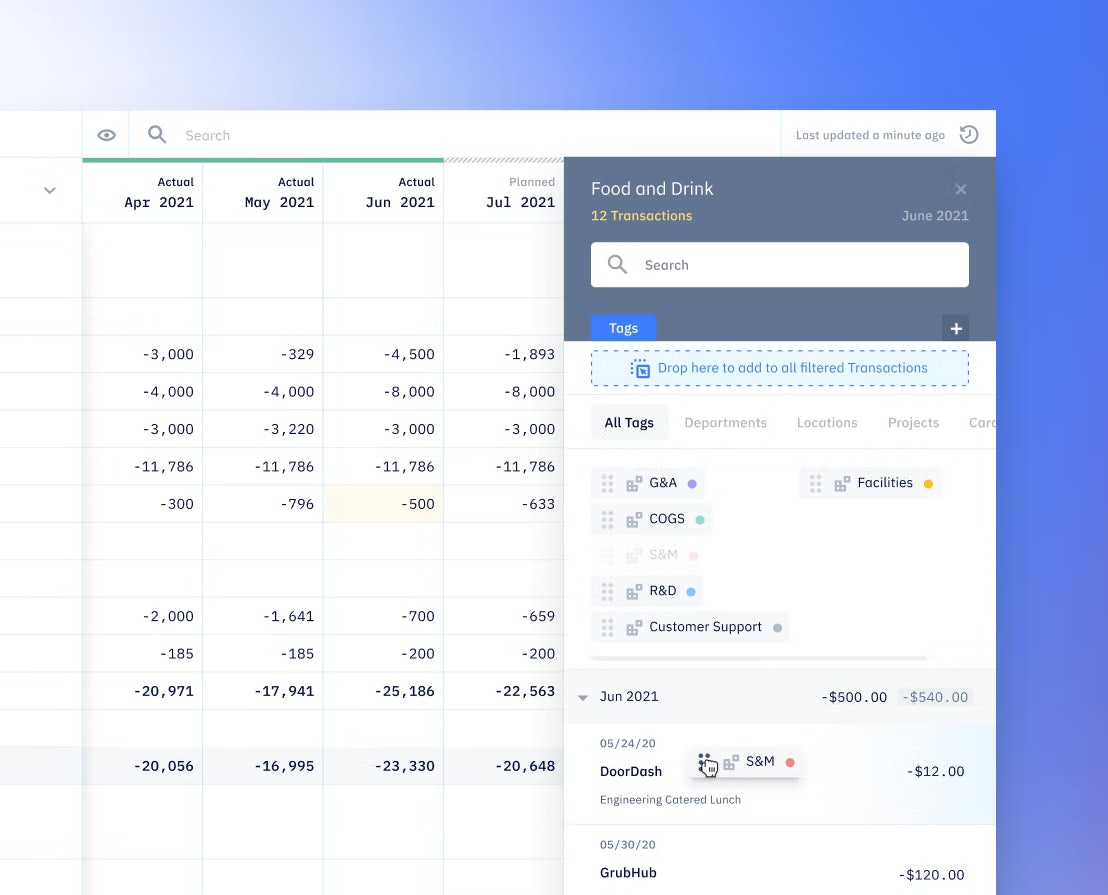

With Pry, you can add sub-accounts to give you even more fine-grained breakdowns of your finances. This allows you to investigate which expenses work well and which don't.

And with Pry, you can even change or reorder transactions in your financial reports. You can drag and drop any transaction directly on your financial report and file it under the correct expense category.

Start departmentalizing your startup expenses with a free Pry trial today.